By early 2018, Dogecoin’s market capitalization was around $2 billion.

Alarmed, founder Jackson Palmer wrote in a Vice op-ed: “Dogecoin’s valuation is the result of market mania that has resulted in inexperienced investors buying up low-priced assets on a whim, hoping that they will follow Bitcoin’s meteoric trajectory.”

In 2014, Palmer said he created Dogecoin to avoid this market mania: “A lot of the coins that have popped up — and this is kind of why I created Dogecoin in the first place — [were made] purely so people could create a bunch of hype around it and do what’s called ‘pump and dump.’”

Pump and dump schemes, which are illegal, involve a group of people building enthusiasm around a cryptocurrency to drive up the price and then sell it at peak; a common variant on the pump and dump scheme — the crowd pump — involves maintaining the coin at this higher price.

By 2018, pump and dumpers saw a moneymaking opportunity with the Dogecoin.

Consider John McAfee. In 2018, John and his employee Jimmy Watson saw the memecoin as an opportunity to make money quickly. In early January of that year, Watson recommended Dogecoin to McAfee for a pump and dump. Watson purchased 6.7M DOGE for 4.1 BTC. Then, around a week after the purchase on January 8th, McAfee, who had a significant Twitter following, sent out a tweet endorsing Dogecoin as his “Coin of the Week.” The tweet did not disclose their financial stake in the cryptocurrency.

Almost immediately after the tweet was sent, Watson sold the Dogecoin for a profit of around 3 BTC. Using the same technologies as the tippers and founders––e.g., the coin itself and social media––McAfee and Watson constructed Dogecoin as a moneymaking technology, albeit through an illegal pump and dump.

In court, they were found guilty of pumping and dumping.

The pump and dumpers rose to new prominence in 2020 and 2021 during the pandemic.

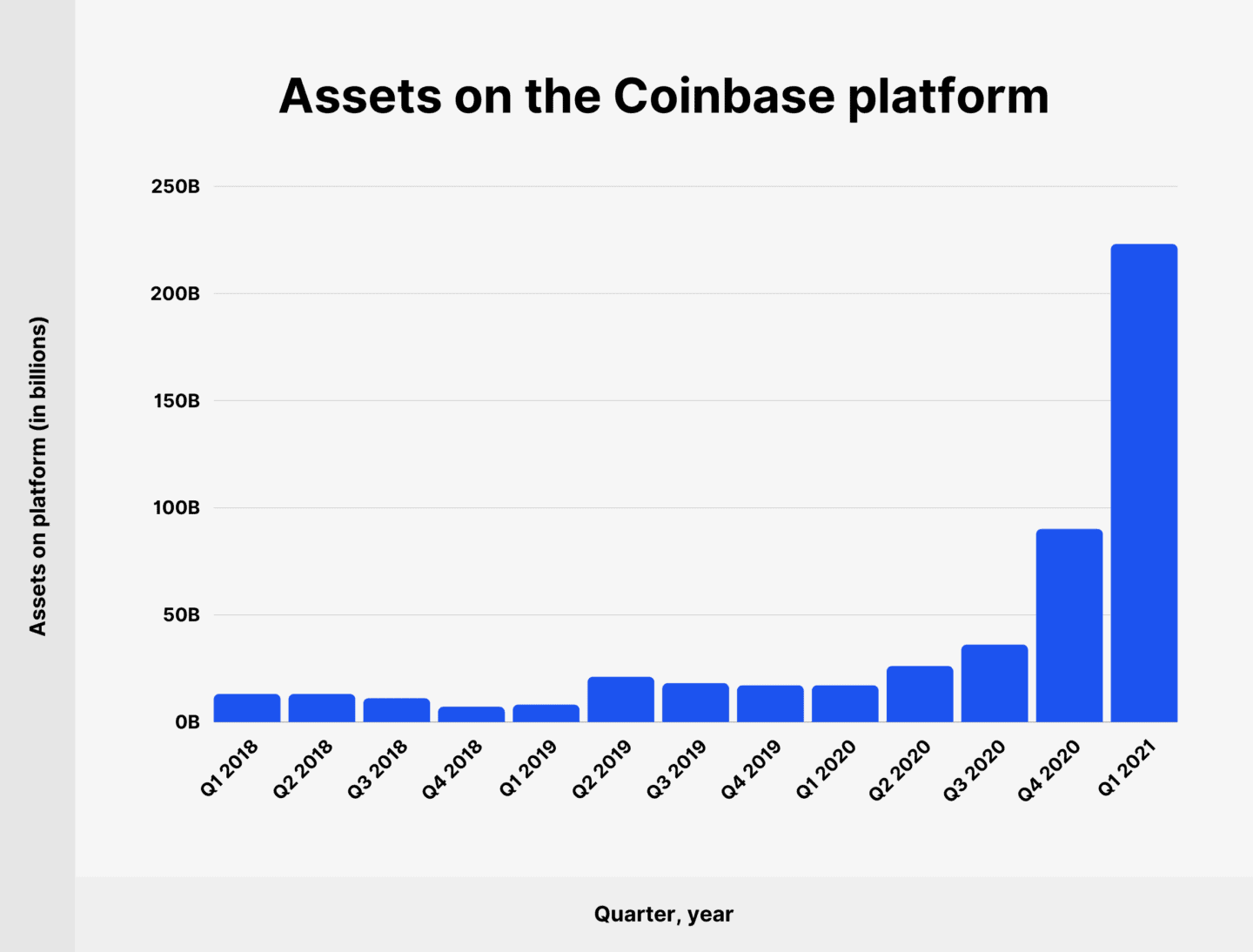

The COVID-19 stimulus checks from the US government gave Americans additional income to invest, and popular apps like Coinbase — whose userbase doubled during COVID — made it easier for these casual investors to buy cryptocurrency. At the same time, the financial burdens of housing costs and student loan debt led many young people to look for risky investments that could result in quick, massive earnings.

Dogecoin was an appealing option — not only because it could lead to fast financial returns but also because these hyper-online investors believed that in a media-saturated world, something viral like a meme-based cryptocurrency was increasingly valuable. With stimulus checks to spend and easy trading platforms to use, these pump and dumpers saw Dogecoin as an apt investment opportunity: It was potentially risk, potentially high return, and definitely attention grabbing.

The first of two COVID-era crowd pump schemes started on TikTok in July 2020 when user James G (@cannolicrypto) posted a video that said: “Let’s all get rich! Dogecoin is practically worthless. There are 800 million TikTok users. Invest just $25. Once the stock hits $1, you’ll have 10 grand. Tell everyone you know.” The video got over half a million views in twenty-four hours, and follow-up videos on TikTok echoed the same message, fueling a viral trend.

To these TikTokers, Dogecoin was about getting rich; these TikTok videos used the language of the mainstream financial market — e.g., “stock” and “shares” — to legitimize Dogecoin as a financial asset, and some of the videos even explicitly called for “pumping” up the price of the coin. Thanks to this TikTok trend, the price of Dogecoin increased by 20% in a few hours and later by more than 200%.

Six months later, Dogecoin experienced a second crowd pump. On January 28, 2021, users in the Reddit group r/SatoshiStreetBets proposed a crowd pump of Dogecoin. One of the early posts read: “Let’s make DOGIECOIN a thing. That’s it, that’s the post.” The forum filled with posts such as “Dogecoin was and always will be the first meme stock, before GME [GameStop’s ticker]” and “IN DOGE WE TRUST #ALLIN.”

In 24 hours, the price of Dogecoin increased by 800%, going from $0.0077 to $0.07. That month, Dogecoin reached a total market capitalization of nearly $8.5 billion, placing it as the ninth largest cryptocurrency.

These pump and dumpers capitalized on the fact that social media strongly influenced cryptocurrency prices, and Dogecoin — because it was derived from a viral Internet meme — was more susceptible to social media driven price changes than other cryptocurrencies.

The participation of these pump and dumpers in the Dogecoin market ostracized those seeking to use the currency for more benign uses like tipping; as the coin’s financial value increased, its small-scale tipping usefulness decreased.

In February 2021, founder Billy Markus — after years of silence in the Dogecoin community — posted an open letter in r/Dogecoin on Reddit. In the letter, he defined “True Value” as “the positive things Dogecoin brings to the world.”

“Pumping and dumping, rampant greed, scamming, bad faith actors, demanding from others, hype without research, taking advantage of others — those are all worthless,” he wrote. “Joy, kindness, learning, giving, empathy, fun, community, inspiration, creativity, generosity, silliness, absurdity. These types of things are what makes Dogecoin worthwhile to me.”

This letter underscored the tension between the tippers’ and pump-and-dumpers’ attempts to define a cryptocurrency that, by its very nature, is interpretatively flexible.

But then another social group — the crypto tastemakers — tried to bring both of these ethos together. More on Elon Musk, Mark Cuban, Snoop Dogg, and the tastemakers in the next post.

Sources

Agarwal, Basant, Priyanka Harjule, Lakshit Chouhan, Upkar Saraswat, Himanshu Airan, and Parth Agarwal. “Prediction of Dogecoin Price Using Deep Learning and Social Media Trends.” EAI Endorsed Transactions on Industrial Networks and Intelligent Systems 8, no. 29 (2021): e2–e2.

“CFTC Charges Two Individuals with Multi-Million Dollar Digital Asset Pump-and-Dump Scheme | CFTC.” Accessed December 11, 2023. https://www.cftc.gov/PressRoom/PressReleases/8366-21.

Cointelegraph Staff. “What Makes Dogecoin Valuable?” Cointelegraph. Accessed December 9, 2023. https://cointelegraph.com/learn/what-makes-dogecoin-valuable.

Corva, Frank. “Coinbase Statistics 2023: Users, Revenue and More.” finder.com, February 21, 2023. https://www.finder.com/coinbase-statistics.

Cryptopedia Staff. “Dogecoin (DOGE): The Significance of a Joke Crypto.” Gemini, November 1, 2023. https://www.gemini.com/cryptopedia/dogecoin-joke-cryptocurrency.

Herrman, John. “The Assorted Teachings of Dogecoin.” The New York Times, May 15, 2021, sec. Style. https://www.nytimes.com/2021/05/15/style/dogecoin-cryptocurrency-investment.html.

Kharpal, Arjun. “Reddit Frenzy Pumps up Dogecoin, a Cryptocurrency Started as a Joke.” CNBC, January 29, 2021. https://www.cnbc.com/2021/01/29/dogecoin-cryptocurrency-rises-over-400percent-after-reddit-group-talks-it-up.html.

Koeltl, John. Commodity Futures Trading Commission v. McAfee, No. Case No. 21-cv-1919 (JGK) (Southern District of New York 2022).

La Morgia, Massimo, Alessandro Mei, Francesco Sassi, and Julinda Stefa. “The Doge of Wall Street: Analysis and Detection of Pump and Dump Cryptocurrency Manipulations.” ACM Trans. Internet Technol. 23, no. 1 (February 2023). https://doi.org/10.1145/3561300.

Lansiaux, Edouard, Noé Tchagaspanian, and Joachim Forget. “Community Impact on a Cryptocurrency: Twitter Comparison Example between Dogecoin and Litecoin.” Frontiers in Blockchain 5 (2022): 6.

Markus, Billy. “True Value - an Open Letter from Billy Markus, Co-Founder and Original Creator of Dogecoin : U/Billymarkus2k.” Reddit, February 2021. https://www.reddit.com/user/billymarkus2k/comments/lfuk3r/true_value_an_open_letter_from_billy_markus/.

Nagarajan, Shalini. “Dogecoin, a Digital Token That Started as a Joke, Spikes 140% after Traders in a Crypto-Themed Reddit Forum Trigger Wall Street Bets Copycat Rally.” Markets Insider. Accessed December 9, 2023. https://markets.businessinsider.com/currencies/news/dogecoin-price-crypto-reddit-traders-satoshistreetbets-trigger-copycat-wsb-rally-2021-1-1030015774.

Nani, Albi. “The Doge Worth 88 Billion Dollars: A Case Study of Dogecoin.” Convergence 28, no. 6 (2022): 1719–36.

Noyes, Jenny. “An Interview With The Creator Of Dogecoin: The Internet’s Favourite New Currency.” Junkee, January 22, 2014. https://junkee.com/an-interview-with-the-inventor-of-dogecoin-the-internets-favourite-new-currency/27411.

ONeal, Stephen. “Dogecoin Gains 20% Amid TikTok Pumping Challenge.” Cointelegraph, July 7, 2020. https://cointelegraph.com/news/dogecoin-gains-20-amidst-tiktok-pumping-challenge.

Palmer, Jackson. “My Joke Cryptocurrency Hit $2 Billion and Something Is Very Wrong.” Vice (blog), January 11, 2018. https://www.vice.com/en/article/9kng57/dogecoin-my-joke-cryptocurrency-hit-2-billion-jackson-palmer-opinion.

Roose, Kevin. “He’s a Dogecoin Millionaire. And He’s Not Selling.” The New York Times, May 14, 2021, sec. Technology. https://www.nytimes.com/2021/05/14/technology/hes-a-dogecoin-millionaire-and-hes-not-selling.html.

Sigalos, MacKenzie. “How Dogecoin Went from a Joke to One of the World’s Top Cryptocurrencies.” CNBC, May 7, 2021. https://www.cnbc.com/2021/05/07/what-is-dogecoin.html.

TikTok. “#dogecointiktokchallange.” Accessed December 11, 2023. https://www.tiktok.com/tag/dogecointiktokchallange.